Securing a business loan is essential to growing your business or navigating challenging times. Whether you need funding for expansion, equipment purchase, or other business needs, understanding how to obtain a business loan is essential. In this blog, we will discuss the steps you can take to increase your chances of getting a business loan.

Steps to Get a Business Loan

Prepare a Business Plan:

A well-crafted business plan showcases your business’s strengths, goals, and financial projections. Lenders want to see that you have a clear vision for your business and a strategy for repayment. Include details about your target market, competition analysis, and revenue forecast to demonstrate the viability of your business.

Improve Your Creditworthiness:

Lenders will evaluate your creditworthiness, so it’s important to have a strong credit profile. Pay your bills and existing debts on time, reduce credit card balances, and correct any errors on your credit report.

Research Different Lenders:

Explore various lending options to find the best fit for your business. Traditional banks, credit unions, online lenders, and government-backed loan programs all have different requirements and terms. Compare interest rates, repayment options, and loan amounts to find the lender that aligns with your needs and financial situation.

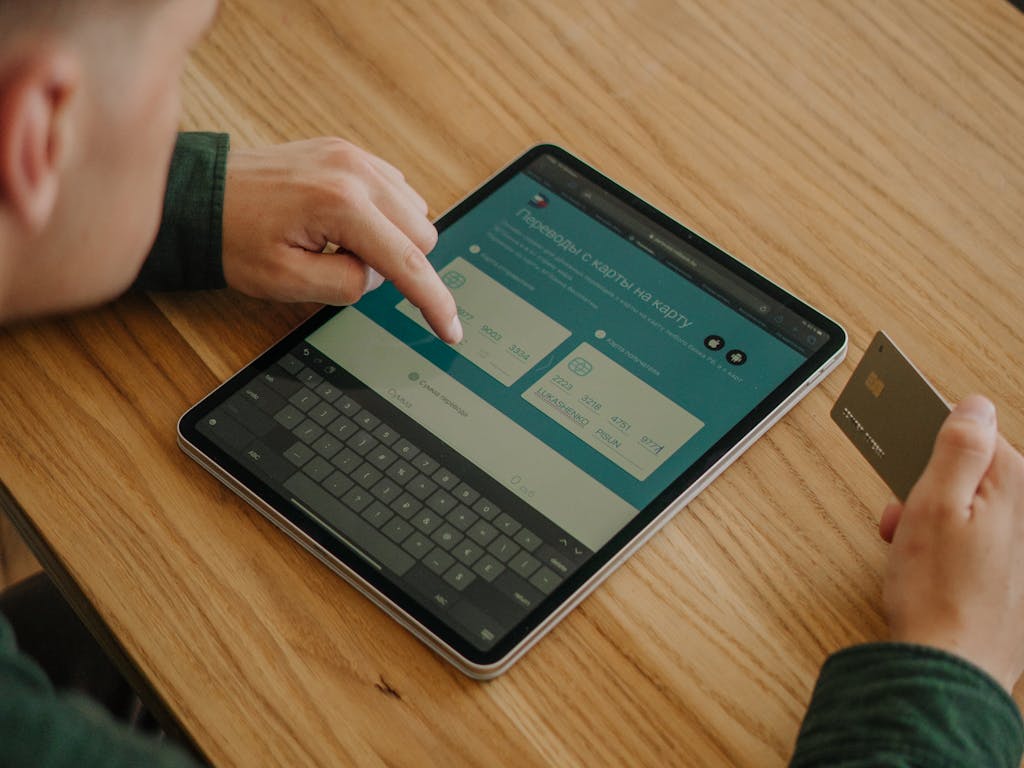

Gather Required Documentation:

Lenders will request specific documentation to assess your business’s financial health and your ability to repay the loan. This typically includes tax returns, financial statements (balance sheet and income statement), bank statements, and legal documents such as licenses or leases. Have these documents organized and readily available for the loan application process.

Additional Tips and Considerations

Build a Good Relationship with The Lender:

Establishing a relationship with the lender before applying for a loan can be beneficial. Attend networking events, join business organizations, and connect with loan officers. Building rapport and demonstrating your business knowledge and professionalism can enhance your credibility during the loan application process.

Consider Collateral or Guarantees:

Depending on the type of loan and lender, you may need to provide collateral or personal guarantees. Collateral can be assets such as real estate, equipment, or inventory that the lender can claim in case of default. Personal guarantees require the business owner to take personal responsibility for loan repayment.

Prepare a Strong Loan Proposal:

Create a comprehensive loan proposal that outlines how you plan to use the loan proceeds, your proposed repayment terms, and the potential return on investment for the lender. This showcases your preparedness and assures the lender that you have a solid plan for utilizing the loan.