Obtaining a home loan is an essential part of the process for most homebuyers. However, navigating the world of home loans can be complex and overwhelming. Below, we will provide a step-by-step guide to help you understand the home loan process and increase your chances of securing a loan that fits your needs.

From evaluating your financial readiness to choosing the right loan and completing the application, this guide will walk you through each stage of obtaining a home loan.

Step-By-Step Guide to Home Loans

Assess Your Financial Readiness:

Evaluate your credit score, debt-to-income ratio, and savings. Review your credit report for any errors and try to improve your creditworthiness by paying off debts and reducing credit card balances.

Research Home Loan Options:

Familiarize yourself with the different types of home loans available. This includes options such as conventional loans, FHA loans, VA loans, and USDA loans, each with its own eligibility criteria, down payment requirements, and interest rates. Evaluate the pros and cons of each loan type to select the one that best suits your financial situation and homeownership goals.

Get Pre-Approved:

The pre-approval process involves submitting financial documents like tax returns, W-2s, pay stubs, and bank statements to a lender for review. Pre-approval gives you a clear idea of how much you can borrow and increases your credibility when making an offer on a home.

Compare Lenders:

Research and compare mortgage lenders to find the one that offers competitive rates, favorable loan terms, and excellent customer service. Look beyond interest rates and consider factors such as reputation, responsiveness, and flexibility. Request loan estimates from multiple lenders to evaluate the overall cost of the loan and compare terms.

Additional Tips and Considerations

Understand Loan Terms and Costs:

Thoroughly review the terms and costs associated with the loan. This includes interest rates, loan fees, origination fees, and closing costs. Factor in the long-term costs of the loan, such as monthly payments, over the life of the loan.

Gather Required Documents:

Prepare all necessary documents for the loan application, such as tax returns, W-2s, pay stubs, and proof of assets. Organize these documents early in the process to facilitate a smooth loan application.

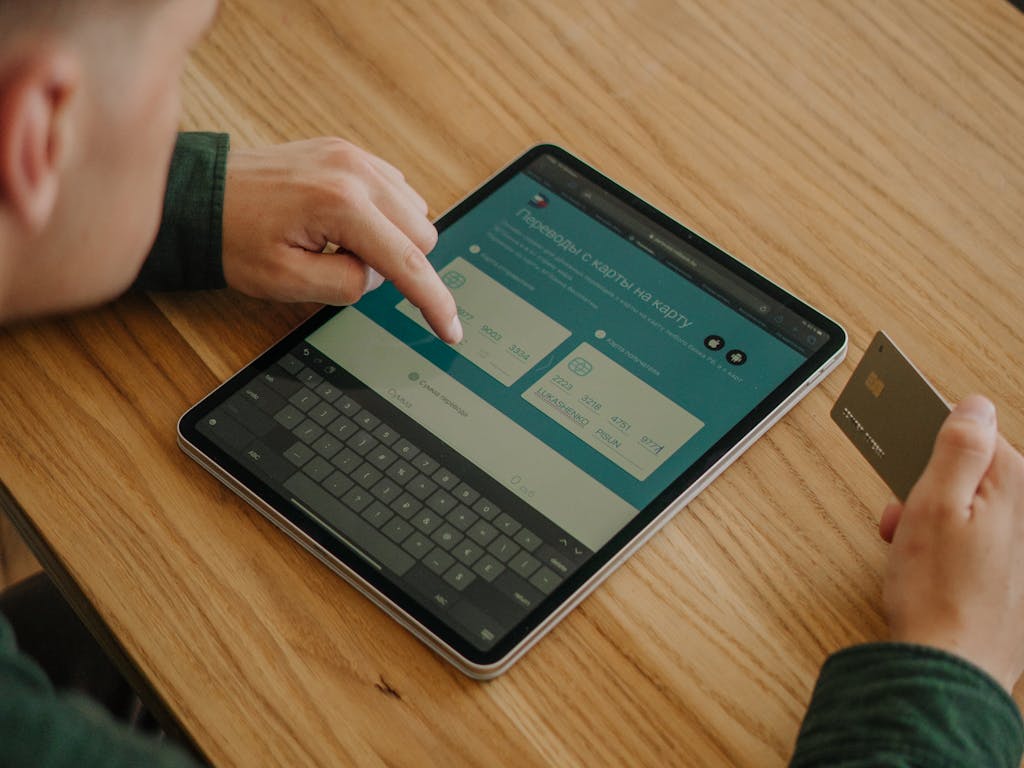

Submit Your Loan Application:

Complete a loan application with the lender of your choice. Provide accurate and detailed information to streamline the application process.

Underwriting and Closing:

After receiving the application, the lender will conduct an underwriting process to assess your creditworthiness and the property’s value. If approved, the lender will send you a commitment letter outlining the terms and conditions of the loan.